From gold to silver

We have explained before the major significance of the gold market for the international monetary systems, either the currently main one and the emerging one in Asia.

The growth of the new IMS is strongly related to the size of the gold market in Asia. Any currency has to be traded against gold to provide an absolutely necessary measure of its changing value. The price of yuan in gold is a corner stone, and this market must not be rigged. That's why this market has to be operated end-to-end in China, from the internationally traded futures contracts denominated in yuan up to the metal delivery.

It is important to understand that the metal spot price is determined first by the price of the metal futures contracts when such a market exist. That's the way spot prices are best formed.

China has built these markets during the past decade, starting from non-monetary metals futures (copper, palladium...) exchange in Shanghaï (SHFE), first for mainland investors then internationally traded contracts. Chinese learned at each step, then SHFE opened a gold market, and quick after the silver market. Here is a summary.

Silver futures markets in Shanghaï (SHFE), London and New-York (COMEX)

China is the world’s largest silver producer after Mexico.

April 2012 the silver futures were introduced as an alternative investment instrument for China’s private investors, and to allow China to influence the global silver price.

September 2012 SHFE has reported the first physical delivery on a silver futures contract through its own platform.

At the same time, LBMA announced the cessation of silver forwards SIFO means releases with effect from 5th November 2012.

The trading volume exploded at SHFE : one year later, SHFE was the world first market for silver contracts above COMEX. This gap grew last year.

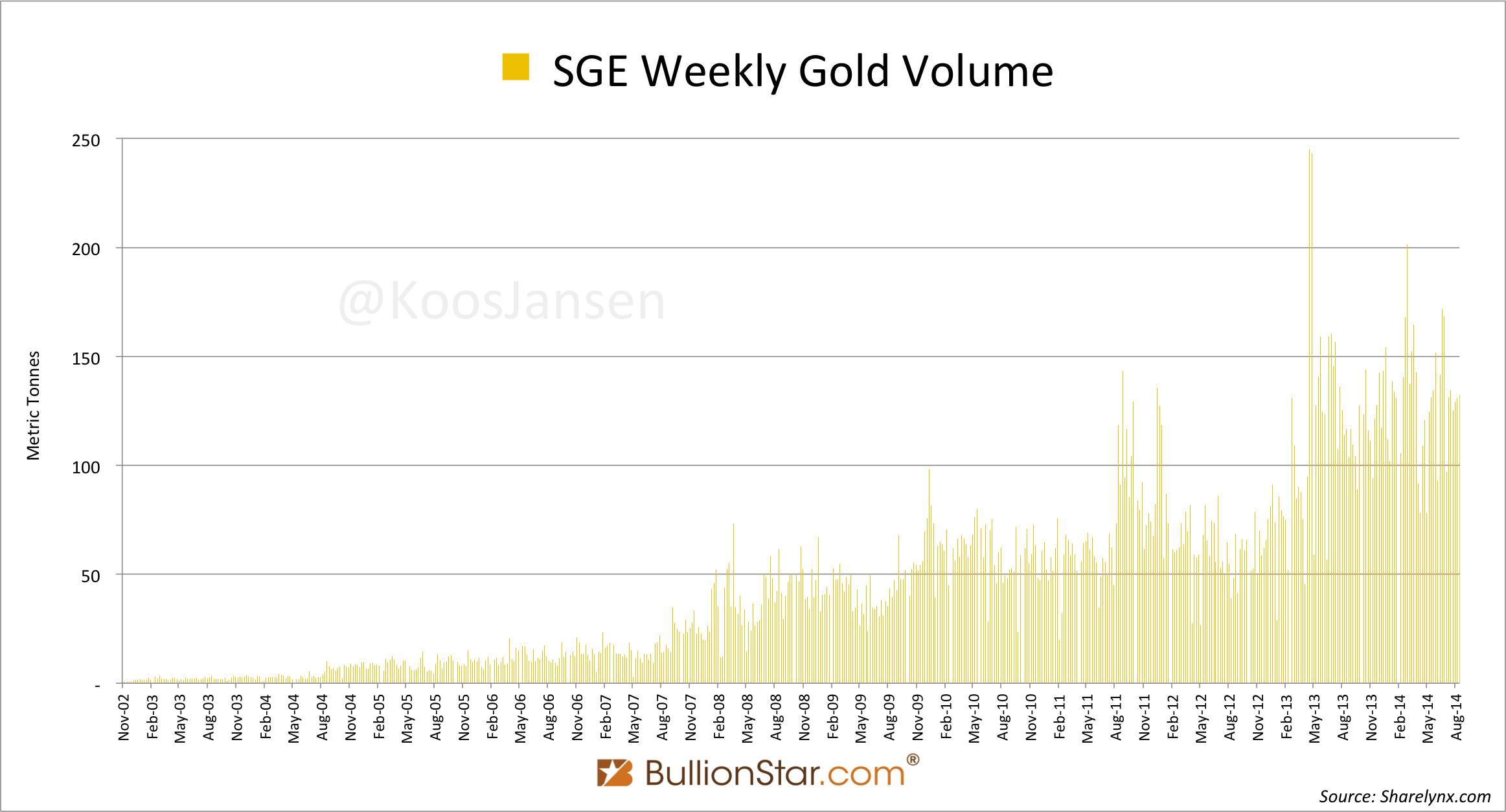

Source: BullionStar / Koos Jansen

"In 2013 total volume traded on the COMEX was 2,176,519 tonnes in silver futures; the SHFE traded 2,557,430 tonnes, 18 % more.

In 2014 total volume traded on the COMEX was 2,123,387 tonnes in silver futures, the SHFE traded 2,908,168 tonnes, 37 % more."

Gold futures markets in SHFE and COMEX

China is the world’s largest gold producer and consumer.

In 2012 more than 70% of all gold futures volume were traded on COMEX, where gold futures contracts exchange was launched on 31 December 1974.

Tokyo TOCOM has been trading gold since 1982, India MCX since 2003.

The Shanghai Futures Exchange (SHFE) introduced gold futures contracts to the Chinese market 1/9/2008. It grows to include night trading hours for gold and silver July 2013.

Very recently 9/18/2014 SGE opened of the International Board of gold metal traded in yuan. As expected, gold trading volumes have exploded :

These graphs compare gold trading volumes in SGE, SHFE, COMEX:

2015 SHFE + SGE gold trading volume will be higher than COMEX gold volume.

Western metal markets have no solution but giving up London and New-York.

In July 2012, Hong Kong Exchanges and Clearing (HKEx) bought the London Metal Exchange (LME), starting with non monetary metals. LBMA announced last month its GOFO market will stop 01/30/2015. GOFO is the London flavor of gold futures (forwards contracts).

As we wrote before:

"The next victim will be COMEX gold futures market. We can anticipate again a growing internationalized gold futures market in Shanghaï (SHFE International Board) at the same time."

This step was officially announced a few days ago : just when GOFO market will close this month, Hong-Kong will open its first internationally traded gold futures contract, with CMEGroup which is operating gold COMEX market.

HKEx trading is closely linked to SHFE. CMEGroup has recently joined and now confirms its ambition for these new gold futures contracts first announced Sept. 11, 2014.

Aucun commentaire:

Enregistrer un commentaire